We now have all been in a scenario after we are in pressing want of arduous money however don’t have our ATM card on us. However, the one factor that we’re at all times (like 99% of the time) is our telephones. Nationwide Funds Company of India (NPCI) understands that and has unveiled UPI ATM money withdrawal capabilities. This revolutionary resolution is geared toward simplifying the method of cardless money withdrawals at ATMs, particularly throughout emergencies.

The function dubbed Interoperable Cardless Money Withdrawal (ICCW) will assist you to seamlessly use your smartphone and most well-liked UPI app to simply dispense money at ATMs. Proceed studying under to be taught how one can additionally use UPI to withdraw money from ATMs.

A Information to Withdraw Money Utilizing UPI ATM

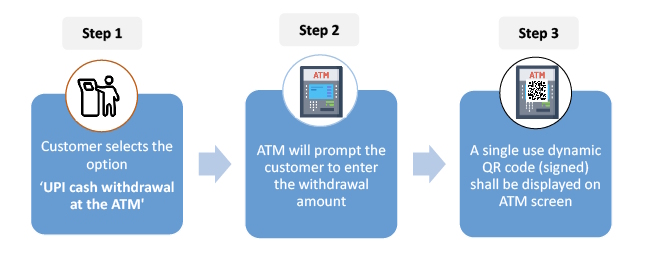

In the event you discover a UPI-compatible ATM, observe the steps under to withdraw money from the ATM utilizing your favourite UPI app:

- From the choices on the display screen, you must choose the “UPI Cardless Money” or “UPI Money Withdrawl” choice.

- Proceed to enter the quantity you want to withdraw in 100, 500, 1,000, 2,000, and 5,000 denominations (relying on the ATM).

- Within the subsequent step, the machine will generate a single-use QR code on your chosen quantity.

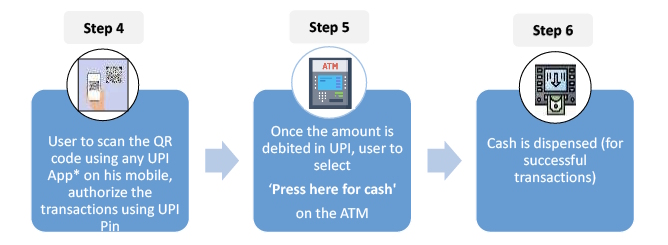

- Now, you should use any UPI app put in in your iPhone or Android telephone to scan the QR code

- Authorize the transaction by inputting your UPI PIN. And that’s it!

- The ATM will dispense your money and a affirmation notification will seem in your chosen UPI app.

- Make sure that to gather your money earlier than leaving the ATM kiosk.

Furthermore, the NPCI has partnered with Hitachi Cost Providers to launch the first-ever UPI ATM in India. The White Label ATM (WLA), dubbed because the Hitachi Cash Spot UPI ATM, will facilitate QR-based cardless money withdrawal.

How Is UPI ATM Totally different from Cardless Money Withdrawal?

With UPI-based money withdrawal, you possibly can take pleasure in the identical seamless profit as cardless money withdrawal. Nonetheless, the important thing distinction is that you don’t want to supply your telephone quantity and depend on OTPs to confirm your transaction. With the UPI ATM performance, all you might want to do is scan the displayed QR code in your smartphone. Union Minister Piyush Goyal posted a video on X (previously Twitter) showcasing this function in motion:

Additionally, whereas utilizing UPI ATMs, the withdrawal restrict is about at Rs 10,000, and it is possible for you to to simply change between completely different accounts out of your put in UPI app. The money withdrawal shall be a part of your present day by day UPI transaction restrict, so watch out whereas withdrawing cash from ATMs.